- What are Trading Times?

- Exness Trading Hours for Different Markets

- Market Opening and Closing Times on Exness

- Exness Time Zones and Adjustments

- How Exness Handles Trading Hours During Holidays

- Trading Times and Strategy

- Exness Tools to Track Trading Hours

- Comparison: Exness Trading Times vs. Other Brokers

- Conclusion

- FAQ

What are Trading Times?

Definition of Trading Times

Trading times refer to the specific hours during which financial instruments can be bought or sold. These hours are set by the exchanges or brokers and vary depending on the asset class and the market.

Example

Forex markets operate 24/5, starting on Sunday evening (UTC) and closing on Friday evening (UTC). In contrast, stock markets like the NYSE have fixed hours, such as 1:30 PM to 8:00 PM UTC.

Importance of Trading Times

- Market Liquidity: Liquidity and volatility often vary based on trading sessions, making it critical to know when markets are most active.

- Avoiding Off-Hours: Trading outside market hours can result in wider spreads and less favorable conditions.

- Strategic Planning: Traders can align their strategies with market openings, closings, and high-impact news events.

Exness Trading Hours for Different Markets

Forex Market Trading Hours

Forex trading on Exness is available 24 hours a day, five days a week, aligning with the global Forex market schedule:

- Start Time: The market opens on Sunday at 5:00 PM UTC.

- End Time: Trading closes on Friday at 5:00 PM UTC.

Forex trading spans major sessions, including: - Tokyo (Asian Session): 12:00 AM to 9:00 AM UTC.

- London (European Session): 7:00 AM to 4:00 PM UTC.

- New York (American Session): 12:00 PM to 8:00 PM UTC.

The overlap between the London and New York sessions is particularly active and volatile.

Stock and Indices Trading Hours

Stock and index CFDs on Exness follow the trading hours of their respective exchanges. Some key examples:

- US Stocks (NYSE, NASDAQ): 1:30 PM to 8:00 PM UTC.

- UK Stocks (London Stock Exchange): 8:00 AM to 4:30 PM UTC.

- Asian Indices (Nikkei, Hang Seng): Nikkei opens at 12:00 AM UTC and closes at 6:00 AM UTC, while Hang Seng operates from 1:30 AM to 8:00 AM UTC.

Commodities and Energy Trading Hours

Commodities such as gold, silver, and oil typically follow the trading hours of major commodity exchanges:

- Gold and Silver: Trading usually starts on Sunday at 6:00 PM UTC and closes on Friday at 6:00 PM UTC, mirroring COMEX hours.

- Oil (WTI, Brent): NYMEX hours apply, with trading available from Sunday at 11:00 PM UTC to Friday at 10:00 PM UTC.

Cryptocurrency Trading Hours

Cryptocurrencies on Exness, including Bitcoin, Ethereum, and Litecoin, are available for trading 24/7. This uninterrupted schedule provides flexibility but may include occasional maintenance periods:

- Maintenance Breaks: Some downtime may occur for platform updates or liquidity adjustments. These are typically brief and announced in advance.

By understanding Exness trading times for different asset classes, traders can plan their activities more effectively, ensuring access to optimal market conditions for their strategies.

Market Opening and Closing Times on Exness

How Market Opening and Closing Affects Trading

Market opening and closing times significantly impact trading conditions:

- Low Liquidity at Open: Liquidity is typically lower during market openings, leading to wider spreads and potential price gaps.

- High Volatility at Close: As markets prepare to close, volatility often increases due to end-of-day trades and position adjustments by institutions.

Example: The opening of the Asian session on Monday may exhibit erratic price movements due to the lower trading volume, while the closing of the New York session on Friday may experience heightened volatility.

Session Overlaps

The overlap between major trading sessions provides the most liquidity and trading opportunities:

- London/New York Overlap: Occurring from 12:00 PM to 4:00 PM UTC, this is the most liquid period for Forex trading, as the world’s largest financial centers operate simultaneously.

- Tokyo/London Overlap: Offers moderate liquidity but can still present opportunities for traders interested in Asian and European markets.

Example: The London-New York overlap is a prime time for day traders due to tighter spreads and increased trading volumes.

Exness Time Zones and Adjustments

Understanding Time Zones

Exness uses UTC (Coordinated Universal Time) as the reference for its trading hours, ensuring clarity across global markets. Traders can also adjust their time zone preferences within the platform to align with their local time.

Example: A trader in New York can customize their Exness platform settings to view trading hours in EST for easier scheduling.

Daylight Saving Time (DST)

Daylight Saving Time affects the trading hours of certain markets, particularly in the US and Europe:

- Spring (March): Market hours may shift one hour earlier.

- Fall (November): Market hours revert to standard time.

Example: During DST, the New York Stock Exchange may open at 12:30 PM UTC instead of 1:30 PM UTC. Exness adjusts its trading schedules accordingly to reflect these changes.

How Exness Handles Trading Hours During Holidays

Holiday Market Closures

During major public holidays, certain markets may close entirely or operate on reduced schedules:

- Forex: The Forex market typically remains open, but liquidity may decrease due to bank holidays in major financial centers.

- Stocks and Indices: Stock markets, like the NYSE or LSE, are closed on holidays such as Christmas, New Year, and Easter.

Example: On Christmas Day, most stock exchanges are closed, and trading on Exness for related CFDs is unavailable.

Special Holiday Hours

Exness communicates any changes in trading schedules due to holidays well in advance. Traders can access this information via the platform’s announcements or the trading calendar to plan accordingly.

Trading Times and Strategy

Impact of Trading Hours on Strategy

Trading times directly influence strategy effectiveness:

- High-Liquidity Periods: Strategies such as scalping or day trading perform best during high-liquidity periods, like session overlaps.

- Low-Liquidity Periods: Swing traders may find quieter sessions, such as the Asian session, more suitable for placing longer-term trades.

Example: A day trader might focus on the London-New York overlap, while a position trader could benefit from the calmer movements during the Tokyo session.

Volatility and Market Times

Certain market times are associated with higher volatility, often driven by major economic events or announcements:

- Economic Announcements: Non-Farm Payrolls (NFP), interest rate decisions, and GDP reports can trigger sharp price movements.

- Session Openings and Closings: The start or end of trading sessions often sees a spike in volatility.

Example: A trader focusing on the EUR/USD pair might target the release of the European Central Bank’s interest rate decision during the London session.

Exness Tools to Track Trading Hours

Exness Trading Tools

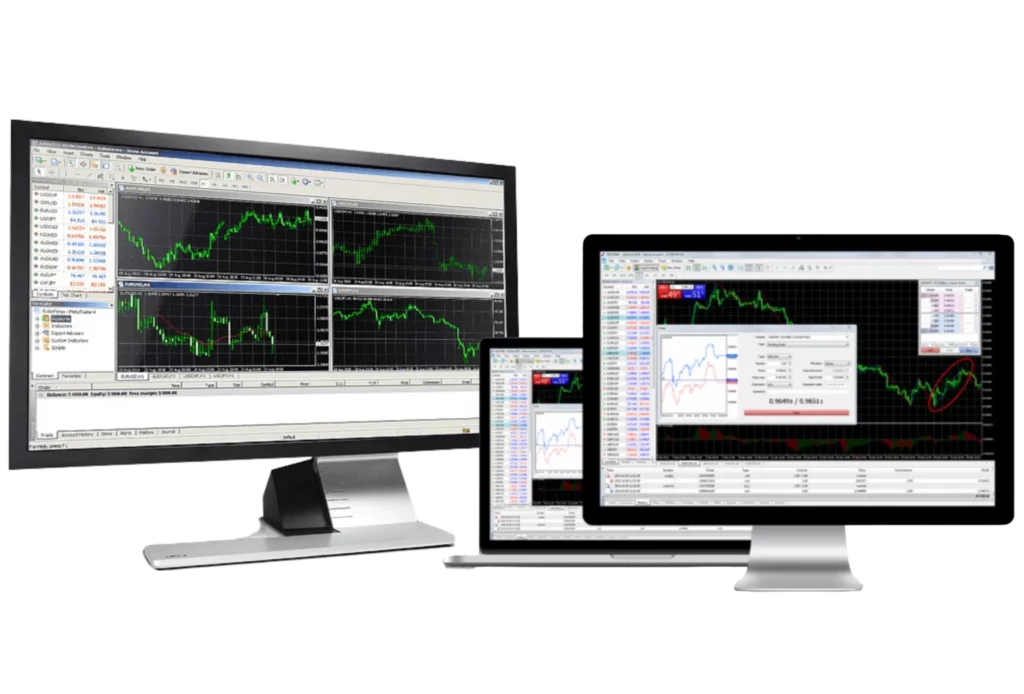

Exness provides several tools to help traders stay on top of market hours:

- Economic Calendar: Displays upcoming market-moving events, ensuring traders are prepared for potential volatility.

- Session Indicators: These tools highlight active trading sessions directly on the trading platform, making it easier to track market activity.

Exness Trading Alerts

Traders can set up alerts and notifications to stay informed about:

- Market Opening and Closing Times: Receive reminders before key sessions begin or end.

- Event Updates: Alerts for significant economic announcements or changes in trading hours due to holidays.

By leveraging Exness tools and tailoring strategies to market hours, traders can optimize their trading performance and better manage risks across various market conditions.

Comparison: Exness Trading Times vs. Other Brokers

How Exness Stands Out

Exness distinguishes itself from other brokers by offering unparalleled flexibility and access to markets:

- 24/5 Forex Trading: Exness provides uninterrupted forex trading from Sunday 5:00 PM UTC to Friday 5:00 PM UTC, matching global market standards.

- 24/7 Cryptocurrency Trading: Unlike many brokers that limit crypto trading to specific hours, Exness supports round-the-clock cryptocurrency trading, giving traders unmatched access to this volatile market.

- Transparency in Trading Hours: Exness clearly communicates trading hours for all instruments and adjusts them for holidays or daylight saving time changes, ensuring traders are always informed.

Global Access

Exness caters to a global audience by accommodating traders across various time zones:

- Localized Platforms: With time zone customization options, Exness ensures traders worldwide can view trading times in their local format.

- Wide Asset Availability: From Forex to commodities, stocks, and cryptocurrencies, Exness provides access to a diverse range of markets with competitive hours.

This global accessibility and flexibility position Exness as an ideal choice for traders looking for convenience and reliability.

Conclusion

Exness offers competitive and flexible trading times across a wide range of assets, from Forex to cryptocurrencies. Its round-the-clock support for crypto trading, 24/5 forex availability, and transparent adjustments for holidays and daylight saving changes provide traders with unmatched flexibility.

Take advantage of Exness’ extensive market access and flexible trading hours. Whether you’re a day trader seeking high-liquidity periods or a swing trader targeting quieter sessions, Exness offers the tools and access you need to plan and execute your trading strategies effectively.

Frequently Asked Questions (FAQs)

What time does Exness open for forex trading?

Exness opens for forex trading at 5:00 PM UTC on Sunday and remains open until 5:00 PM UTC on Friday, aligning with global forex market hours.